7 tips to improve your financial health

With financial stress impacting one in five Aussie workers, see what steps you could take to improve your financial wellbeing.

Some days you might feel confident you can meet your needs within the boundaries of your current income, whereas other days you may feel like you don’t have nearly enough funds in order to do so.

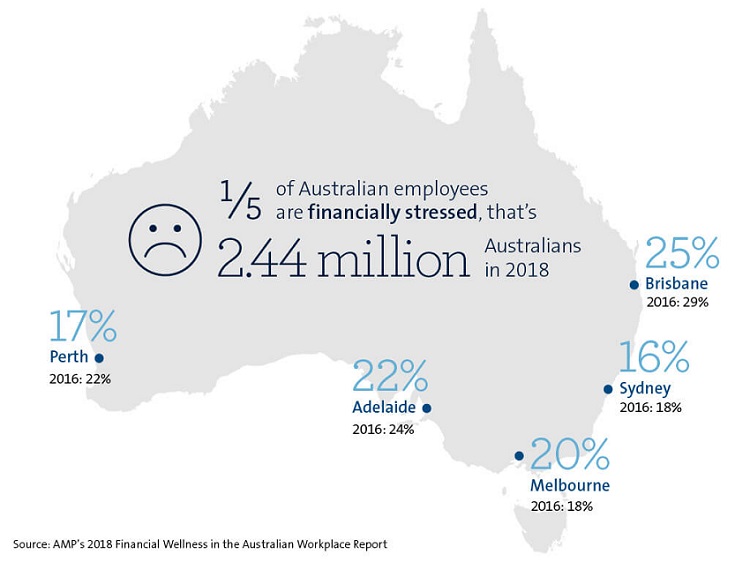

The truth is, you’re not alone. Nearly 2.5 million Aussies say they feel moderately to severely financially stressed, even though financial stress has been decreasing year-on-year in Australia1.

If you’re interested to know more, we take a look at some of the findings that came out of AMP’s 2018 Financial Wellness in the Australian Workplace Report, in addition to what steps you could put in place to potentially improve your financial position and wellbeing.

Findings from the 2018 financial wellness report

Some of the figures that came out of the report revealed the following2:

- The number of Aussie employees feeling financially stressed across the board in 2018 was 19%, down from 22% in 2016.

- In comparison to 2014 research, Aussies also indicated they had greater disposable income than in years gone by and were spending more money.

- Research participants in 2018 also said they felt more confident in dealing with financial matters and with their own levels of financial understanding.

- Compared to two years ago, fewer people said they were engaging in negative financial behaviours, such as making late repayments on bills and credit cards. At the same time however, there was a decline in positive financial behaviours, such as people making additional repayments on mortgages and putting aside savings for a rainy day.

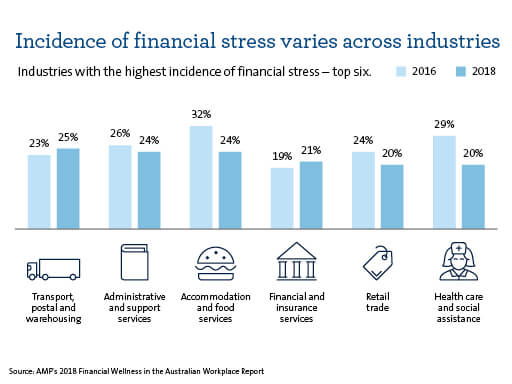

- Of those working Aussies that did indicate that they were financially stressed, this was being felt across all industries, income levels and roles.

Actions that could improve your financial wellbeing

On a positive note, research identified that those who have been financially stressed in the past were often able to recover through changes to their behaviour and mindset3.

Here are some suggestions of things you could do (if you aren’t already) which may help you to improve how you feel financially.

1. Create a budget that works for you

When it comes to creating a budget, try jotting down into three categories – what money is coming in, what cash is required for the mandatory stuff (such as bills), and what dough might be left over (which you may want to put toward existing debts, savings or your social life).

Writing up a budget may take an afternoon out of your diary, but it will help you to more easily identify where there’s room for movement. For instance, could you reduce what you’re spending on luxury items, subscription or streaming services, eating out or clothing?

2. Consider rolling your debts into one

If all the small debts you once had, have multiplied and grown into bigger debts – you could look to roll them into a single loan, and reduce what you pay in fees and interest.

This could help you to save a significant amount of money (depending on what you owe) and make it easier to manage your repayments, as you’ll potentially only need to make one monthly repayment rather than having to juggle several.

The main thing to ensure is you are paying less than what you are currently when it comes to interest rates, fees and charges, and that you’re disciplined about making your repayments.

3. Try to save a bit of money regularly

Even a small amount of cash deposited on a frequent basis could go a long way toward your savings goals, with a separate research report indicating the average savings target for Aussies is a bit over $11,0004.

Some tips people said helped them along the way was transferring spare funds into an actual savings account, setting up automatic transfers to their savings account (so they didn’t have to move money manually) and putting funds into an account which they couldn’t touch5.

4. Set aside some emergency cash

With research showing that an emergency fund of between $4,000 and $5,000 is generally enough to cushion most working Aussies when it comes to unexpected expenses, it’s probably worth some thought6.

An emergency stash of cash could give you peace of mind and reduce the need to apply for high-interest borrowing options should you be faced with a busted phone, car tyre, or bad landlord or lover leaving you financially stranded.

5. Be open to talking money with your partner

One in two Aussie couples admit to arguing about money7, so if you haven’t already, it might be worth sitting down to ensure you’re on the same page and that both parties’ goals are being considered.

Understandably, it may not be the easiest topic to broach, so if you’re looking for some tips, check out our article – 10 money conversations to have with your other half.

6. See if you can get a better deal with your providers

You more than likely have several product and service providers, and figures show you could save more than a grand annually on energy alone just by switching from the highest priced plan to the most competitive on the market8.

Again, this may take a couple of hours out of your day, but the savings you could potentially make may make a real difference to what you cough up throughout the year.

7. Don’t be afraid to seek financial assistance

If you are struggling to make repayments, you may be able to seek assistance from your providers by claiming financial hardship.

All providers must consider reasonable requests to change their terms in instances where you may be suffering genuine financial difficulties and feel help would enable you to meet your repayments, possibly over a longer period.

In addition, you can talk to a financial counsellor (free of charge) at the National Debt Helpline by calling 1800 007 007

About Tailored Lifetime Solutions:

At Tailored Lifetime Solutions we pride ourselves on staying true to our core values of:

- Genuine Care

- Keeping it simple and

- Providing Security and Peace of Mind.

Tailored Lifetime Solutions has been helping Australians secure their Financial future for over 18 years. We understand each of our clients is unique and as such require tailored financial advice to meet their needs. We work to partner our clients on their financial journey, to ensure financial fitness throughout life’s various stages and secure your future financial security.

With over 70 years of financial planning experience between us, our areas of advice include:

- Wealth creation

- Lending and mortgage broking

- Superannuation advice

- Self managed superannuation funds

- Aged Care advice

- Lifestyle financial planning

Providing quality financial advice in Balwyn and the Eastern Suburbs for almost 20 years.

Important information

This information is general information only and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Although the information is from sources considered reliable, AMP does not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP does not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.