Dividends, franking credits and retirement income goals

By Jeff Rogers

Previous Chief Investment Officer, ipac (retired)

The Labor Party’s proposal to eliminate cash refunds for excess franking credits continues to generate lots of discussion by self-funded retirees and members of self-managed super funds (SMSFs) even after some refinements that narrow its impact.

The stated policy intention is to broaden the tax base by eliminating what is described as an anomaly in the operation of the current system. It may also be targeting perceived issues of intergenerational equity and be trying to further curb the growth of self-managed superannuation. None of that sounds too contentious, so why all the angst?

Dermot Ryan has recently discussed the implications of the proposed changes and the actions that SMSF members might consider taking in response. I have previously expressed my view on whether cash refunds for excess franking credits do indeed represent an anomaly. The aim of this article is to try to explain why there is concern among a large group of retirees. I contend that there are both emotional and financial reasons for this.

Doing the right thing

Research in behavioural finance has explored how the emotional needs of investors influence their behaviour. I believe that an expression of loyalty and patriotism, along with comfort from a sense of familiarity, are important factors driving the investment choices of retirees. The home country bias in SMSFs can be interpreted as reflecting an emotional preference for investing in one’s own country. Remember that during the 1990s Australians were actively encouraged to become shareholders in privatised and demutualised domestic entities.

Retirees are clearly affronted by any suggestion that they have been rorting the tax system through the receipt of cash refunds for excess credits. They feel they have been obeying all the rules over the past two decades and have been doing the right thing by allocating capital domestically.

Members of SMSFs see themselves as unfairly targeted since their contemporaries with similar financial resources, but whose superannuation is held within large funds regulated by the Australian Prudential Regulatory Authority, are unlikely to be impacted by the proposals. Worse still, many self-funded retirees are of an age where they are not permitted to change the location of their assets to shield themselves from the effect of the proposal.

Impacts on consistency of cash flows

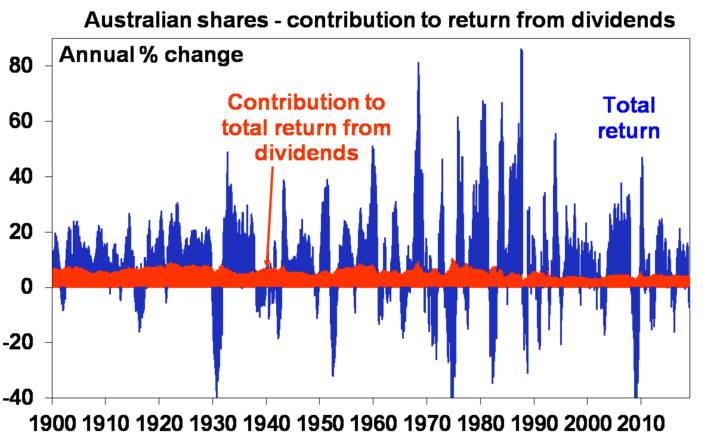

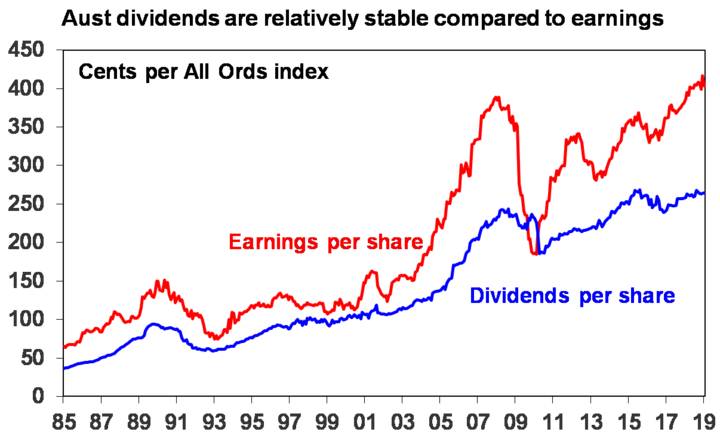

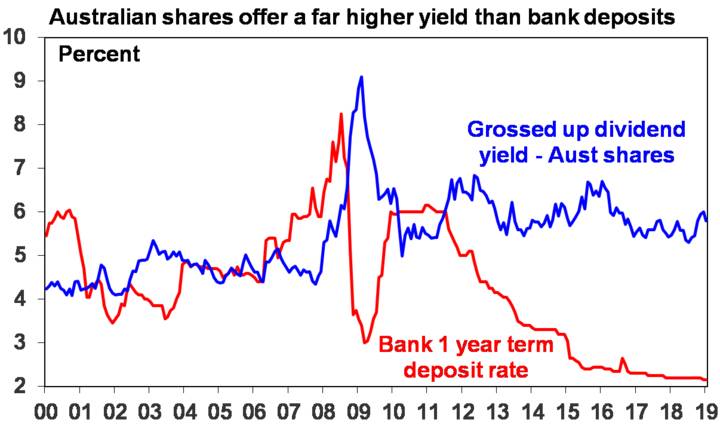

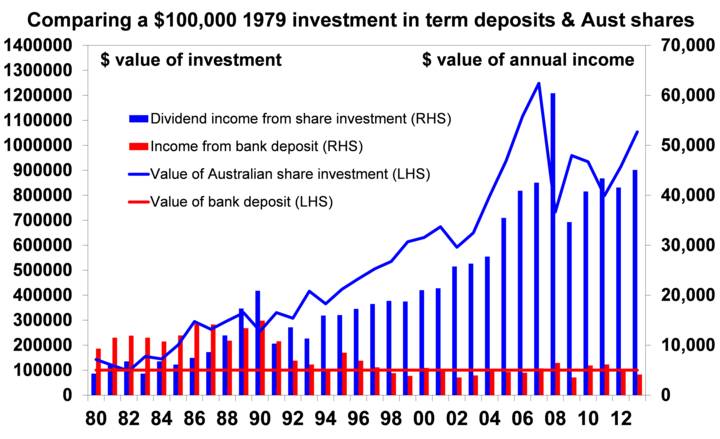

From a financial perspective, it is apparent that many retirees would see a reduction in the after-tax return on their Australian shares if Labor’s proposal were to be implemented. What is less well appreciated is that it would likely also lead to an increase in the variability of cash flows delivered from their retirement portfolios. Australian companies with large and sustainable dividends turn out to be particularly attractive investments for retirees looking to fund a reliable income stream in retirement.

This observation isn’t entirely intuitive to people schooled in thinking that risk and portfolio volatility are one and the same. From a goals-based perspective, portfolio volatility and the risk of failing to meet a retiree’s essential spending goals represent different concepts.

In a recent whitepaper, Darren Beesley notes that a key goal for retirees is to maintain confidence that they will be able to draw consistent cash flow, growing with the cost of living over time, from their retirement portfolio. The capacity to take investment risk and the appropriate characteristics of those risks are informed by their spending goals. A retiree’s investment problem is different to that of an accumulator who has a predictable sequence of future inflation-linked contributions.

Correlation between Australian shares and retirement goals

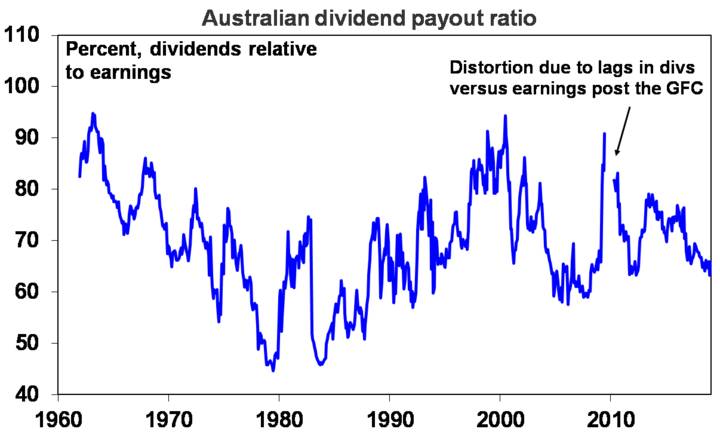

So, why is investment in a portfolio of profitable companies whose shares have attractive return prospects, and where a large proportion of that return is delivered through sustainable dividends and associated imputation credits, so well-suited to reliably fund a retirees’ spending goals?

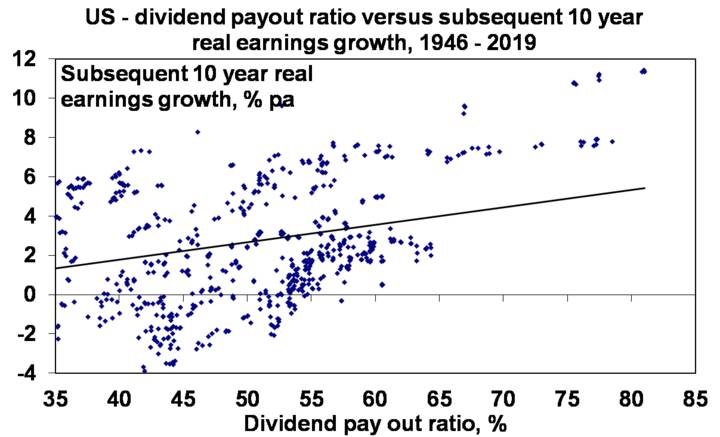

First, shares of such companies can deliver attractive returns on a standalone basis. If history is any guide, portfolios with these characteristics are likely to have a superior total return per unit of investment risk relative to a traditional equity portfolio.

Second, and most importantly, spending on essential needs in retirement has the characteristic of a series of cashflows that rise with the cost of living over time. A retiree needs to fund these cash flows through income from their security holdings supplemented by the progressive sale of assets. Consequently, a share portfolio that generates a high level of sustainable dividends and imputation credits has very attractive attributes because it reduces, or potentially eliminates, the need to sell assets at times of weak asset prices.

Shares with these characteristics may not only improve the reliability of retirees’ financial outcomes but also deliver favourable behavioural benefits by restricting the extent to which volatility of markets is transmitted into uncomfortably large variability of future cash flows from their portfolios. That’s why the implementation of Labor’s proposal could be financially disruptive for a large cohort of retirees.

Possible outcomes

Some commentators have suggested that Australian super funds are over-invested in Australian shares and it would be a good thing if that exposure were to be reallocated to other asset classes, especially global equities. This may well be sound advice for an accumulator in super or a wealth-maximising investor looking for high total return while limiting overall portfolio volatility. However, it isn’t quite right for a retiree looking for confidence in their spending power. Further, retirees looking to reallocate offshore need be thoughtful about the type of shares in which to invest.

Ironically, our goal-based analysis suggests that if there is a desire to reduce access to franking credit it would be better if restrictions were to apply in the accumulation phase of superannuation rather than in the pension phase. That’s unlikely to happen. What may be more likely is that Labor responds to community concerns by allowing self-funded retirees some limited access (say up to $5,000 per year) to refunds on excess credits.