Are you being scammed?

Scamwatch has received over 4160 scam reports mentioning the coronavirus with over $3 360 000 in reported losses since the outbreak of COVID-19 (coronavirus). Common scams include phishing for personal information, online shopping, and superannuation scams.

If you have been scammed or have seen a scam, you can make a report on the Scamwatch website, and find more information about where to get help.

Scamwatch urges everyone to be cautious and remain alert to coronavirus-related scams. Scammers are hoping that you have let your guard down. Do not provide your personal, banking or superannuation details to strangers who have approached you.

Scammers may pretend to have a connection with you. So it’s important to stop and check, even when you are approached by what you think is a trusted organisation.

Visit the Scamwatch news webpage for general warnings and media releases on COVID-19 scams.

Below are some examples of what to look out for.

These are a few examples, but there are many more. If your experience does not match any of the examples provided, it could still be a scam. If you have any doubts at all, don’t proceed.

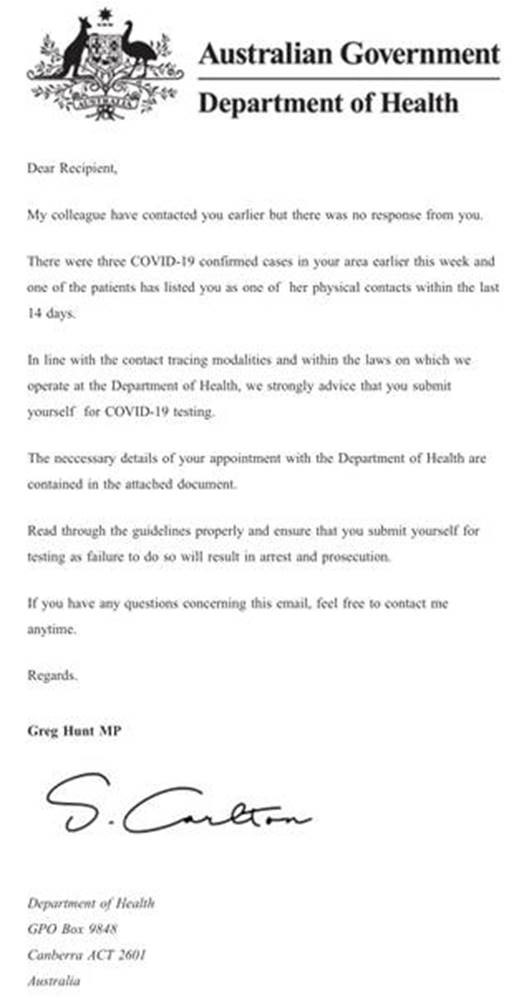

Phishing – Government impersonation scams

Scammers are pretending to be government agencies providing information on COVID-19 through text messages and emails ‘phishing’ for your information. These contain malicious links and attachments designed to steal your personal and financial information.

In the examples below the text messages appear to come from ‘GOV’ and ‘myGov’, with a malicious link to more information on COVID-19.

Examples of phishing scams impersonating government agencies

Department of Health impersonation email

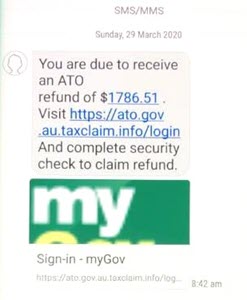

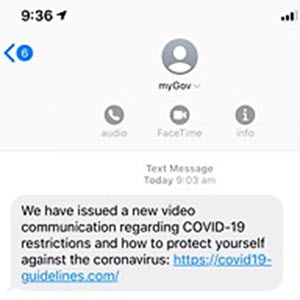

Fake myGov texts

Scammers are also pretending to be Government agencies and other entities offering to help you with applications for financial assistance or payments for staying home.

Examples of payment or financial assistance scams

Fake government subsidy phishing scam

Fake ATO tax credit scam

Fake economic support payment text

Tips to protect yourself from these types of scams:

- Don’t click on hyperlinks in text/social media messages or emails, even if it appears to come from a trusted source.

- Go directly to the website through your browser. For example, to reach the MyGov website type ‘my.gov.au’ into your browser yourself.

- Never respond to unsolicited messages and calls that ask for personal or financial details, even if they claim to be a from a reputable organisation or government authority — just press delete or hang up.

Phishing – Other impersonation scams

Scammers are pretending to be from real and well known businesses such as banks, travel agents, insurance providers and telco companies, and using various excuses around COVID-19 to:

- ask for your personal and financial information

- lure you into opening malicious links or attachments

- gain remote access to your computer

- seek payment for a fake service or something you did not purchase.

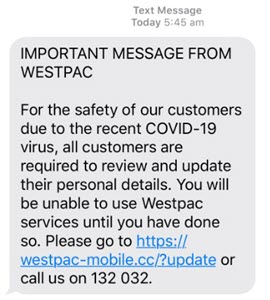

Examples of other phishing scams

Fake bank phishing text

Fake insurance phishing text

Fake voucher phishing text

Tips to protect yourself from these types of scams:

- Don’t click on hyperlinks in text/social media messages or emails, even if they appear to come from a trusted source.

- Never respond to unsolicited messages and calls that ask for personal or financial details — just press delete or hang up.

- Never provide a stranger remote access to your computer, even if they claim to be from a telco company such as Telstra or the NBN Co.

- To verify the legitimacy of a contact, find them through an independent source such as a phone book, past bill or online search.

Superannuation scams

Scammers are taking advantage of people in financial hardship due to COVID-19 by attempting to steal their superannuation or by offering unnecessary services and charging a fee.

The majority of these scams start with an unexpected call claiming to be from a superannuation or financial service.

The scammers use a variety of excuses to request information about your superannuation accounts, including:

- offering to help you access the money in your superannuation

- ensuring you’re not locked out of your account under new rules.

- checking whether your superannuation account is eligible for various benefits or deals.

Example of a superannuation scam

A scammer will call pretending to be from a superannuation or financial service. They may refer to the government’s superannuation early release measures, and ask questions such as:

- Have you worked full time for the last 5 years?

- Are you going to apply for the $10 000 superannuation package?

Or falsely claim:

- Inactive super accounts will be locked if not merged immediately.

Superannuation early-access scams

Many Australians are facing financial hardship due to the COVID-19 pandemic. On 22 March, the Australian Government announced eligible individuals would be allowed early access to their superannuation. Scammers are taking advantage of the government’s early-release measures in a variety of phishing scams designed to steal your superannuation.

For more information, see our Superannuation early-access scams fact sheet.

Tips to protect yourself from these types of scams:

- Never give any information about your superannuation to someone who has contacted you — this includes offers to help you access your superannuation early under the government’s new arrangements.

- Hang up and verify their identity by calling the relevant organisation directly — find them through an independent source such as a phone book, past bill or online search.

- See our Scamwatch media release warning about superannuation scams.

- For more information on superannuation scams visit ASIC’s MoneySmart website.

Online shopping scams

Scammers have created fake online stores claiming to sell products that don’t exist — such as cures or vaccinations for COVID-19, and products such as face masks.

Tips to protect yourself from these types of scams:

- The best way to detect a fake trader or social media shopping scam is to search for reviews before purchasing. No vaccine or cure presently exists for the coronavirus.

- Be wary of sellers requesting unusual payment methods such as upfront payment via money order, wire transfer, international funds transfer, preloaded card or electronic currency, like Bitcoin.

- More information is available at: Online shopping scams.

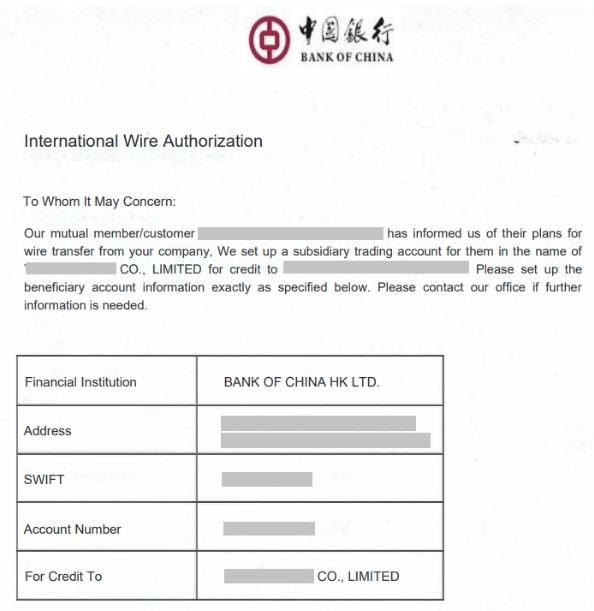

Scams targeting businesses

Scammers are using COVID-19 in business email compromise scams by pretending to be a supplier or business you usually deal with.

Scammers are using COVID-19 as an excuse to divert your usual account payments to a different bank account. Your payment goes to the scammer instead of the real business.

Example of a business email compromise scam

Tips to protect yourself from these types of scams:

- Verify any request to change bank details by contacting the supplier directly using trusted contact details you have previously used.

- Consider a multi-person approval process for transactions over a certain dollar amount, with processes in place to ensure the business billing you is the one you normally deal with.

- Keep the security on your network and devices up-to-date, and have a good firewall to protect your data.

Businesses can also sign up to the ACCC’s Small Business Information Network to receive emails about new or updated resources, enforcement action, changes to Australia’s competition and consumer laws, events, surveys and scams relevant to the small business sector.

How scammers contact you

During a crisis like COVID-19, you may be isolated and using online services more than ever, so it is important to think about who might be really contacting you. They may find you by:

- calling you or coming to your door

- contacting you via social media, email or text message

- setting up websites that look real, and impersonating government, business or even your friends

- collecting information about you so that when they make contact they are more convincing.

How you can help others

You can help others by talking and sharing information about scams when connecting with your friends, family and colleagues.

Ask the businesses you connect with regularly about scams they see, how they can protect you and how you can protect yourself.

If you use social media or particular applications — learn how to report scams to them and choose services that will identify and remove scammers from their platform or website.

Ask your bank or financial institution about how to protect your financial information and how they will help you if you get scammed.

Government, law enforcement, individuals and businesses all play an important role in helping to protect the community from scams.

With the onset of Covid-19 and the resultant changes to accessing superannuation, there inevitably comes the opportunistic people who see the chance to take advantage of those in a vulnerable position.

Scamwatch has seen a 55 per cent increase in reports involving loss of personal information this year compared with the same period in 2019, totaling more than 24 000 reports and over $22 million in losses.

About COVID-19 scams

Scamwatch has received over 3900 scam reports mentioning the coronavirus with over $3.1 million in reported losses since the outbreak of COVID-19 (coronavirus). Common scams include phishing for personal information, online shopping, and superannuation scams.

If you have been scammed or have seen a scam, you can make a report on the Scamwatch website, and find more information about where to get help.

Scamwatch urges everyone to be cautious and remain alert to coronavirus-related scams. Scammers are hoping that you have let your guard down. Do not provide your personal, banking or superannuation details to strangers who have approached you.

Scammers may pretend to have a connection with you. So it’s important to stop and check, even when you are approached by what you think is a trusted organisation.

Visit the Scamwatch news webpage for general warnings and media releases on COVID-19 scams.

Below are some examples of what to look out for.

These are a few examples, but there are many more. If your experience does not match any of the examples provided, it could still be a scam. If you have any doubts at all, don’t proceed.

Phishing – Government impersonation scams

Scammers are pretending to be government agencies providing information on COVID-19 through text messages and emails ‘phishing’ for your information. These contain malicious links and attachments designed to steal your personal and financial information.

In the examples below the text messages appear to come from ‘GOV’ and ‘myGov’, with a malicious link to more information on COVID-19.

Examples of phishing scams impersonating government agencies

Department of Health impersonation email

Fake myGov texts

Scammers are also pretending to be Government agencies and other entities offering to help you with applications for financial assistance or payments for staying home.

Examples of payment or financial assistance scams

Fake government subsidy phishing scam

Fake ATO tax credit scam

Fake economic support payment text

Tips to protect yourself from these types of scams:

- Don’t click on hyperlinks in text/social media messages or emails, even if it appears to come from a trusted source.

- Go directly to the website through your browser. For example, to reach the MyGov website type ‘my.gov.au’ into your browser yourself.

- Never respond to unsolicited messages and calls that ask for personal or financial details, even if they claim to be a from a reputable organisation or government authority — just press delete or hang up.

Phishing – Other impersonation scams

Scammers are pretending to be from real and well known businesses such as banks, travel agents, insurance providers and telco companies, and using various excuses around COVID-19 to:

- ask for your personal and financial information

- lure you into opening malicious links or attachments

- gain remote access to your computer

- seek payment for a fake service or something you did not purchase.

Examples of other phishing scams

Fake bank phishing text

Fake insurance phishing text

Fake voucher phishing text

Tips to protect yourself from these types of scams:

- Don’t click on hyperlinks in text/social media messages or emails, even if they appear to come from a trusted source.

- Never respond to unsolicited messages and calls that ask for personal or financial details — just press delete or hang up.

- Never provide a stranger remote access to your computer, even if they claim to be from a telco company such as Telstra or the NBN Co.

- To verify the legitimacy of a contact, find them through an independent source such as a phone book, past bill or online search.

Superannuation scams

Scammers are taking advantage of people in financial hardship due to COVID-19 by attempting to steal their superannuation or by offering unnecessary services and charging a fee.

The majority of these scams start with an unexpected call claiming to be from a superannuation or financial service.

The scammers use a variety of excuses to request information about your superannuation accounts, including:

- offering to help you access the money in your superannuation

- ensuring you’re not locked out of your account under new rules.

- checking whether your superannuation account is eligible for various benefits or deals.

Example of a superannuation scam

A scammer will call pretending to be from a superannuation or financial service. They may refer to the government’s superannuation early release measures, and ask questions such as:

- Have you worked full time for the last 5 years?

- Are you going to apply for the $10 000 superannuation package?

Or falsely claim:

- Inactive super accounts will be locked if not merged immediately.

Superannuation early-access scams

Many Australians are facing financial hardship due to the COVID-19 pandemic. On 22 March, the Australian Government announced eligible individuals would be allowed early access to their superannuation. Scammers are taking advantage of the government’s early-release measures in a variety of phishing scams designed to steal your superannuation.

For more information, see our Superannuation early-access scams fact sheet.

Tips to protect yourself from these types of scams:

- Never give any information about your superannuation to someone who has contacted you — this includes offers to help you access your superannuation early under the government’s new arrangements.

- Hang up and verify their identity by calling the relevant organisation directly — find them through an independent source such as a phone book, past bill or online search.

- See our Scamwatch media release warning about superannuation scams.

- For more information on superannuation scams visit ASIC’s MoneySmart website.

Online shopping scams

Scammers have created fake online stores claiming to sell products that don’t exist — such as cures or vaccinations for COVID-19, and products such as face masks.

Tips to protect yourself from these types of scams:

- The best way to detect a fake trader or social media shopping scam is to search for reviews before purchasing. No vaccine or cure presently exists for the coronavirus.

- Be wary of sellers requesting unusual payment methods such as upfront payment via money order, wire transfer, international funds transfer, preloaded card or electronic currency, like Bitcoin.

- More information is available at: Online shopping scams.