All major share markets have been sold down heavily over recent days. The correction on equity markets has also been accompanied by ongoing falls in the price of commodities and emerging market currencies. Since the beginning of August, Australian shares are down 12%, with losses of 10% to 12% recorded across the United States, Europe and Japan. Chinese shares have declined 14% since the start of the month.

What has caused the market correction?

There appears to have been little change in underlying market fundamentals, with the economic backdrop remaining relatively stable and supportive of modest company earnings growth. Rather, the sell-off seems to have been largely sentiment driven. AMP Capital Chief Economist Dr. Shane Oliver highlights that markets are currently “full of emotion” and characterised by nervousness.

Underpinning the market’s nervousness seems to be increasing concern over the outlook for Chinese economic growth, ongoing weakness in commodity prices and fears that the combination of falling commodity prices and weaker Chinese growth will be particularly problematic for emerging markets. As a result, funds have flowed out of emerging markets causing sharp falls in many emerging economy currencies.

Is it a correction or something worse?

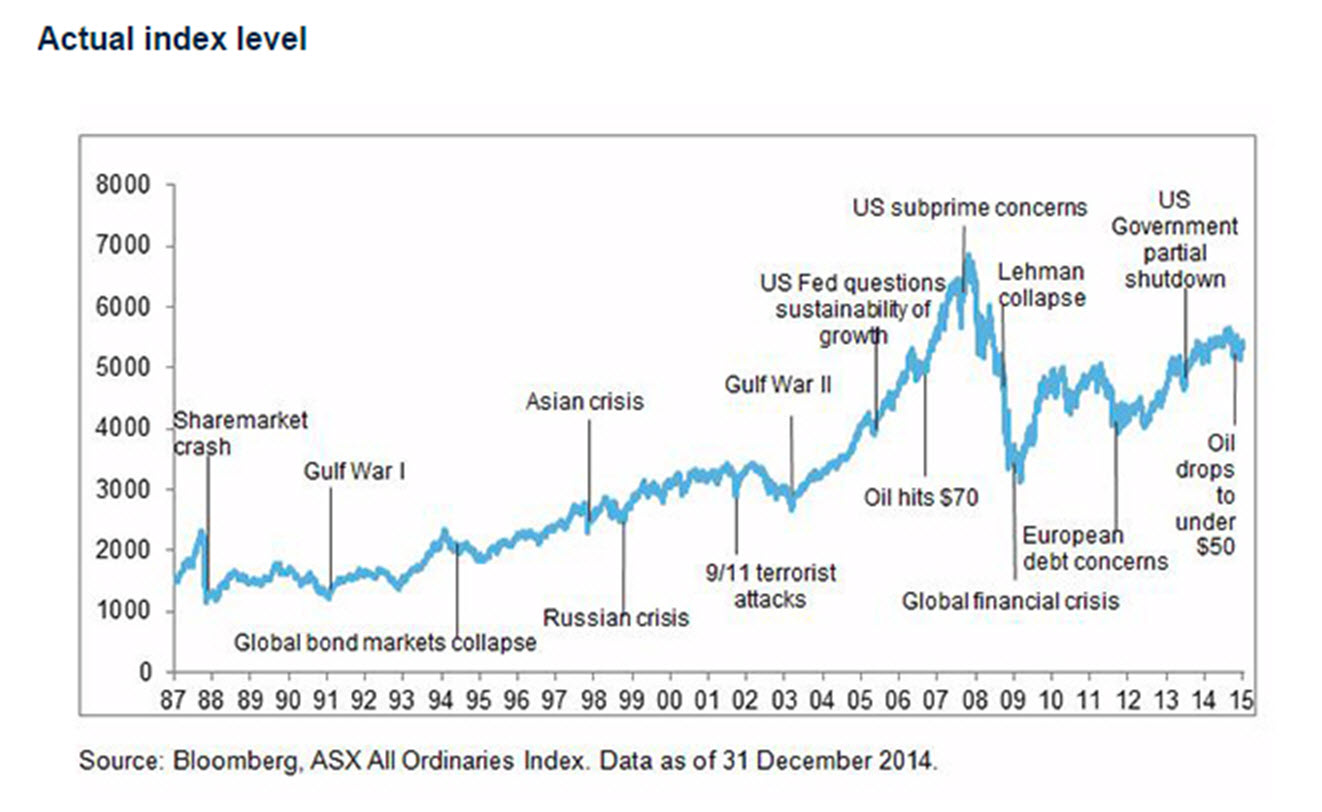

Whilst a fall of the magnitude experienced in recent days was not expected, sharp declines in share markets of up to 20% are not unusual and do not imply there will be an extended period of weakness. In fact, corrections can be a healthy characteristic of “bull” markets, allowing investors to reassess valuations before a rising trend resumes. Dr. Oliver believes that the longer term trend for shares remains upwards, stating that:

“Our view remains that the cyclical bull market in shares likely has further to go. Put simply shares are not seeing the sort of conditions that normally precede a new cyclical bear market: shares are not unambiguously overvalued; they are not over loved by investors; uneven and below trend growth is extending the economic expansion cycle; and monetary conditions are likely to remain easy for a while yet.”

Previous market falls that have preceded more extended market downturns tend to have been associated with financial system dysfunction, excessive overvaluation or imminent economic recession. None of these factors appear to be in place today. In particular, the global economy remains on a modest growth path with low inflation and accommodative policy support creating an environment conducive to company profit growth. Locally, the latest profit reporting for the period ending June 30th, confirmed a steady rise in the profitability of Australian non-mining companies of around 7% from the previous year.

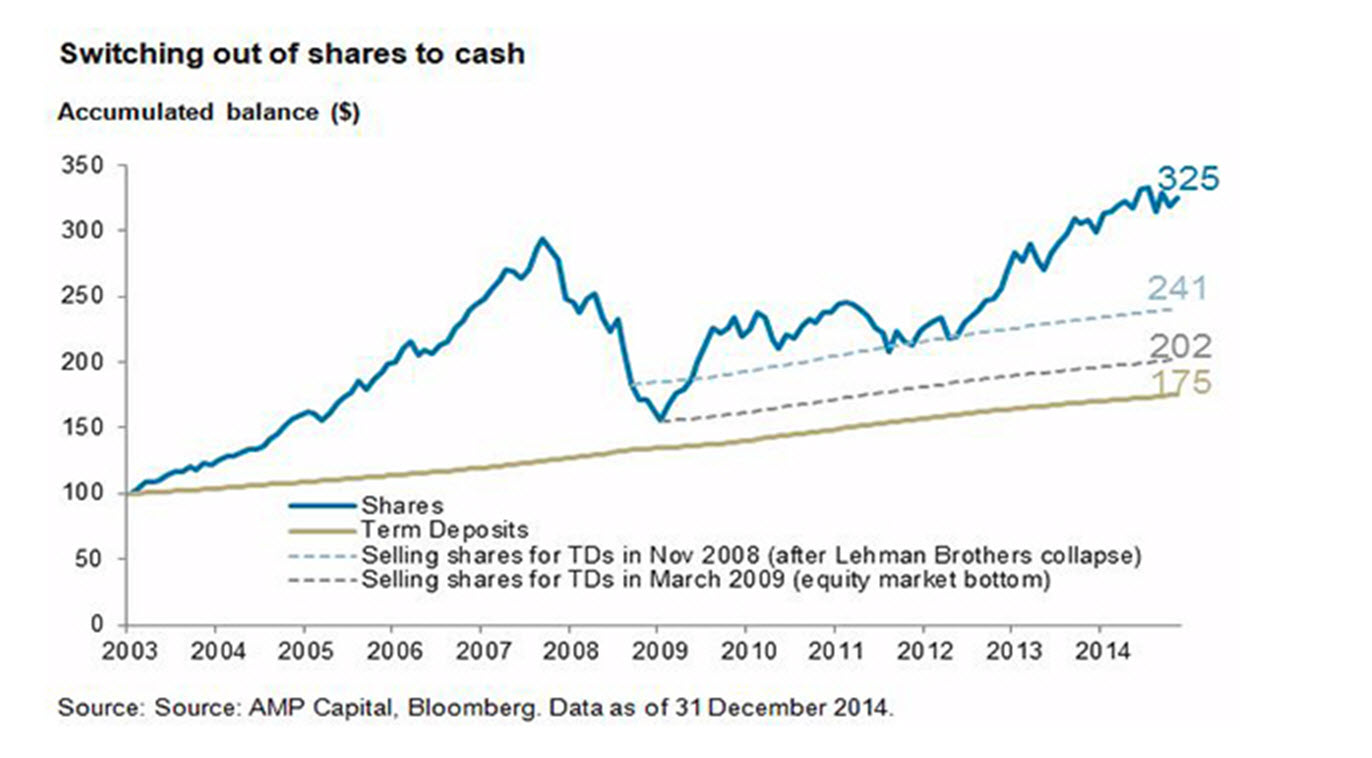

Although share market fundamentals may remain sound, share market valuations can move away from fundamentals for extended periods. As such, the latest sell-off suggests that caution is required by investors, particularly around emerging markets. However, with little change in the outlook for underlying company profitability, investors should maintain longer term strategies and asset allocations. In fact, for investors with underweight positions to equities, the current sell-off may represent an opportunity to enter the market. Please do not hesitate to contact your AMPFP adviser should you wish to discuss recent market events or any aspect of your investment strategy.

If you would like more information on about this or any other financial planning matter, please call our office on (03) 9851 0300 to speak to one of our financial planners.